iK Accounting

Built for small businesses

Every business has unique needs and challenges. Our affordable and flexible software adapts to you. Whether you have a side hustle or a full-time operation, iK Accounting grows with your business.

Designed for simplicity

With iK Accounting’s clean and easy-to-use interface, spend less time figuring out complicated software and more time on your business! Plus, it’s mobile-friendly, so you can manage your business from anywhere.

Save time with automated tracking

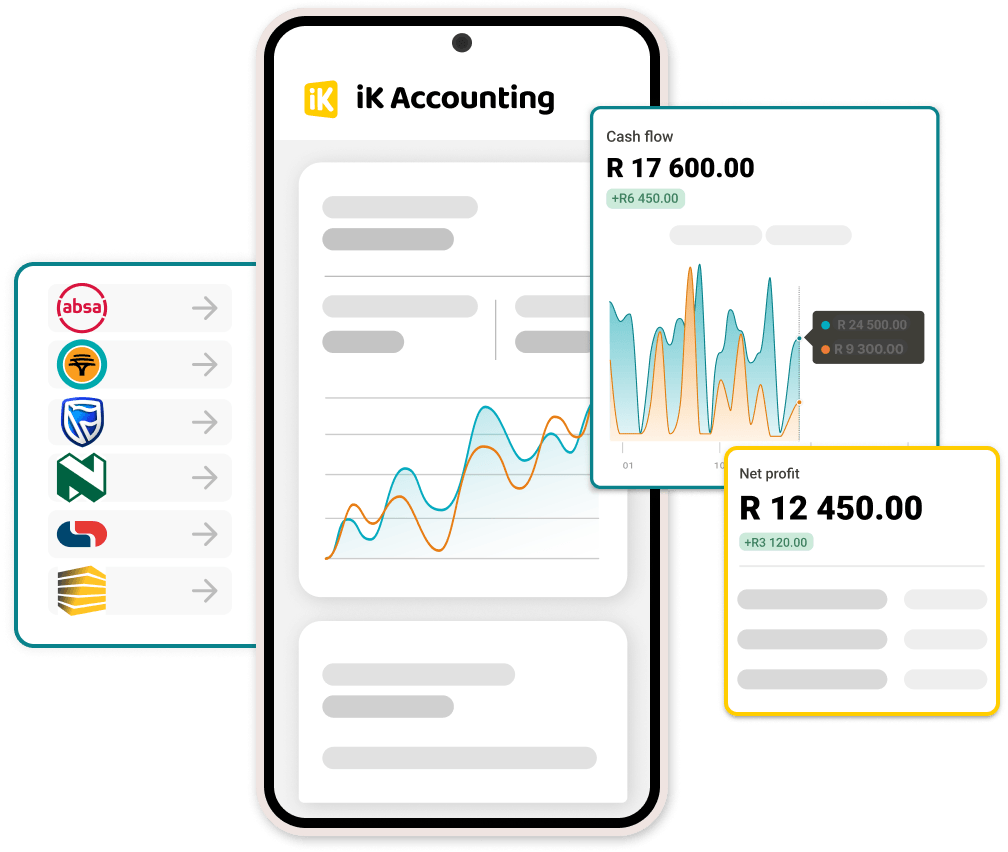

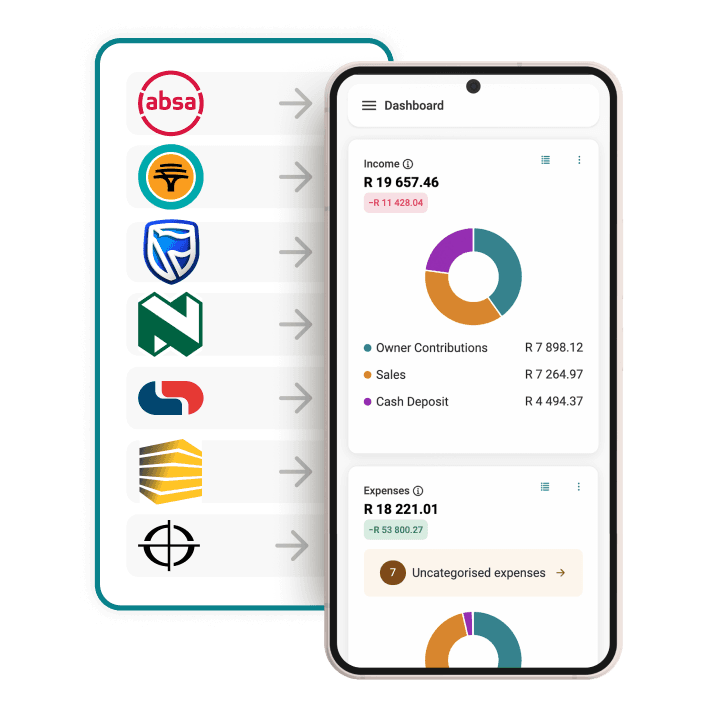

Connect your bank account and let our software do the rest! Secured with the latest encryption technology, effortlessly categorise and track your iKhokha payouts and spending.

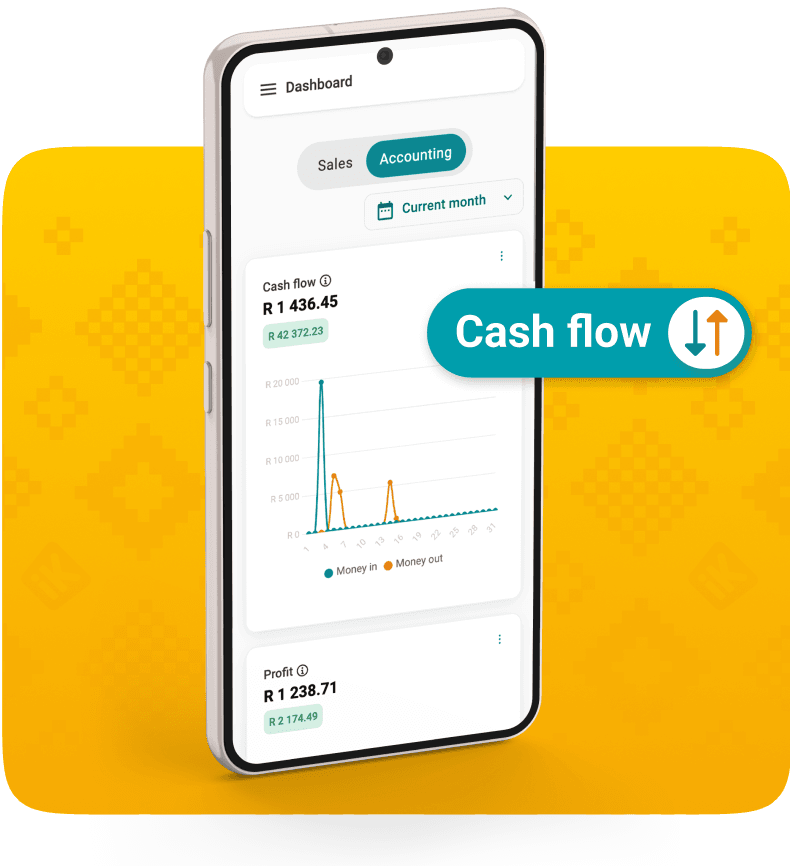

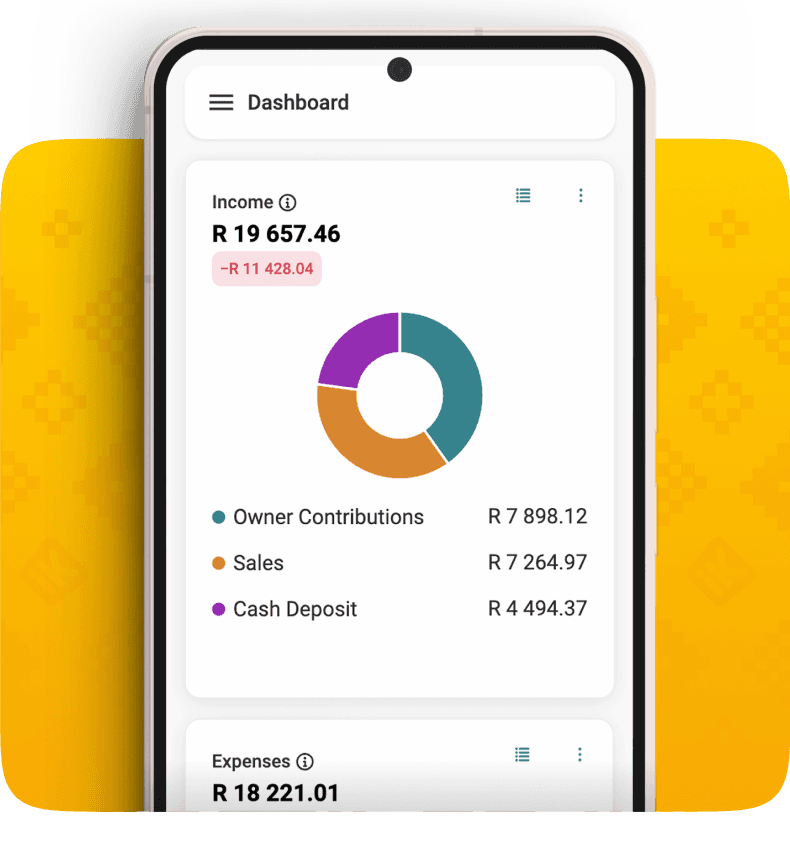

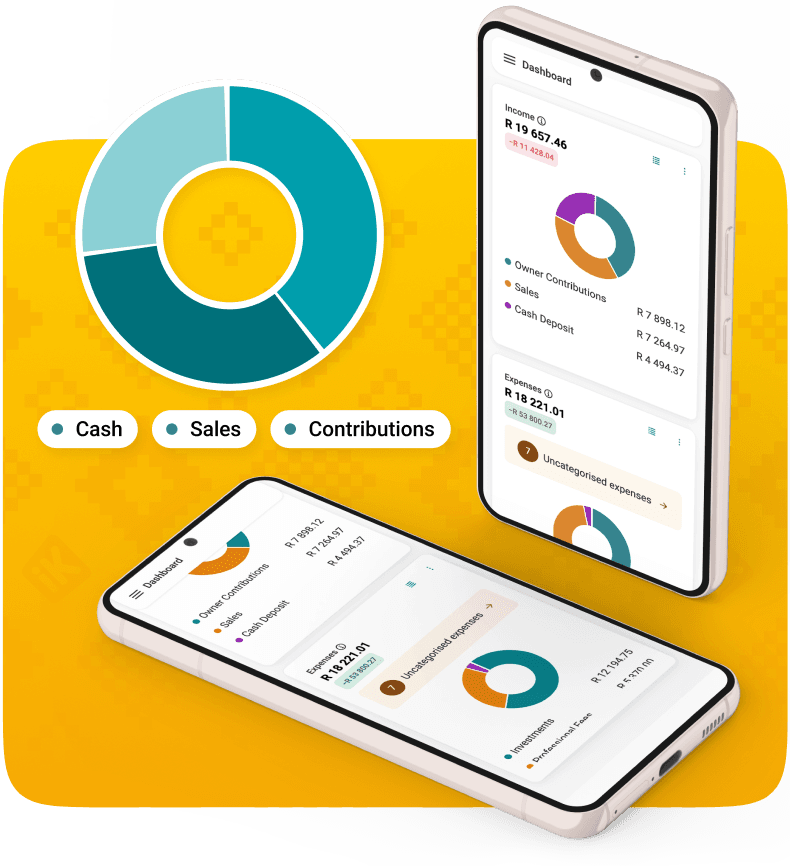

Generate easy real-time reports

Get clear, accurate insights into your financial health and how your business is making money — no accounting degree needed! Get a view of your cash flow, profits and losses, balance sheets, and VAT reports.

Get the full experience by connecting your bank account

Unlock the full power of iK Accounting! Encrypted with the latest technology, iK Accounting connects with: Absa, Capitec, FNB, Nedbank, Standard Bank, TymeBank.

How to get started

Change the way you do admin with easy-to-use small business accounting software made for South Africans.Sign up in minutes, link your bank or iKhokha sales and start tracking your money like a pro, no accounting degree needed.

Product Features

- 1Login to your iK Dashboard. New to iKhokha? Sign up and complete your profile first.

- 2Click “start free trial” to sign up for your free 30-day trial.

- 3Simplify your admin and securely connect your bank account through stub to get the full automated experience.

- 4Simply toggle between your sales dashboard and accounting dashboard to access iK Accounting.

- 5After your free trial, your R189 (along with the VAT) subscription fee will be automatically deducted from that day's payouts.

±5 hours

Save up to 5h per week when you use online accounting software.*

*Estimation based on trends observed in the current market for online accounting software for small businesses.

FAQs

Here are a few benefits of using iK Accounting:

- Saves you time: automates routine tasks like expense tracking.

- Improves accuracy: reduces mistakes normally made with manual data entry and calculations.

- Saves you money: it’s more affordable than hiring a full-time accountant.

- Better planning: gives you real-time insights into your financial health, helping with better decision-making.

- Pain-free compliance: helps ensure compliance with tax regulations by keeping accurate records and generating reports for you.

- Scalability: this small business accounting software grows with your business, evolving without the need for new systems or upgrades.

- Accessibility: Allows you to access financial data from anywhere, making it easier to manage finances on the go.

- Simplifies collaboration: you can share access to your real-time financial data with accountants or financial advisors.

Setting up iK Accounting is easy:

- Login to your iK Dashboard. iK Accounting is only available to iKhokha merchants that are actively getting payouts through us. So, if you haven’t signed up, do that first.

- On your dashboard open tap “Tell me more” in the iK Accounting banner.

- Start your 30-day free trial.

- Connect your bank account to iK Accounting to get the full automated experience.

- After the free trial, we’ll automatically deduct the R189 (excl. VAT) subscription fee from your payouts on the day of billing.

Yes, you can use iK Accounting software without any accounting experience. In fact, it’s designed with simplicity in mind, making it easy to use for the novice right up to the professional.

iK Accounting easily and securely connects with your business bank account through stub’s software. Once you’ve signed up for your free trial, you’ll see the option to connect your bank account on your dashboard. Follow the prompts to get set up.

Used alongside your iK sales dashboard, here are some features you can use:

- Invoicing: iK Invoice lets you create, send, and track your professional invoices.

- Expense tracking: easily categorise and track expenses connecting your bank account. This helps in monitoring spending and managing cash flow.

- Bank reconciliation: Connect your bank account and sync bank transactions to know how your business makes money.

- Financial reporting: generate detailed financial reports like profit and loss statements, balance sheets, and cash flow statements. These reports give insights and help in decision-making.

- Cash flow graph: Helps you see exactly how cash moves in and out of your business.

- Tax preparation: simplify tax filing by keeping track of income and expenses throughout the year.

- iKhokha payouts reconciliation: Automatically syncs iK Payouts and assigns them to income and expenses so that you know when and how much you’ve been paid.

- Inventory management: use My Product and Services to track inventory levels, manage stock, bill for services, and create purchase orders.

- Mobile access: the iK Dashboard is available on your iKhokha App. This lets you manage your finances on-the-go.

Accounting software helps small businesses operate more efficiently, stay organised, protect their sensitive financial data, and make better financial decisions, all of which are critical to their success and growth.

Need help?

Get help instantly on WhatsApp, our chatbot Kelly, or by requesting a callback.

You can also call 087 222 7000 or email support@ikhokha.com