10 Warning Signs You Have Cash Flow Issues in Your Business

Spot the signs before it’s too late. Here are 10 warning signs your business has cash flow issues, and how to get back on track.

BY Sophie Ardé

Table of Contents

- Introduction

- You’re not paying your staff on time

- Late payments to suppliers and vendors

- Cash flow issues can start with late customer payments

- Reduced credit limits or cancelled credit lines

- Growth stalls when you have cash flow problems

- Decreased cash reserves point directly to cash flow issues

- Each slow period is worse than the last

- You’re dipping into personal funds

- Your debt is catching up with your income

- You’re ignoring the numbers

We’ve all been there, standing at the crossroads of financial uncertainty, trying to figure out how to stretch every Rand just to make it to the end of the month. This is a sign of cash flow problems. It’s not something we like to admit, but running a business comes with its financial ups and downs.

If that sounds familiar, you’re not alone. It’s time to spot the warning signs of cash flow issues in your business before things spiral.

Here are the 10 red flags that could be pointing to cash flow issues in your business right now:

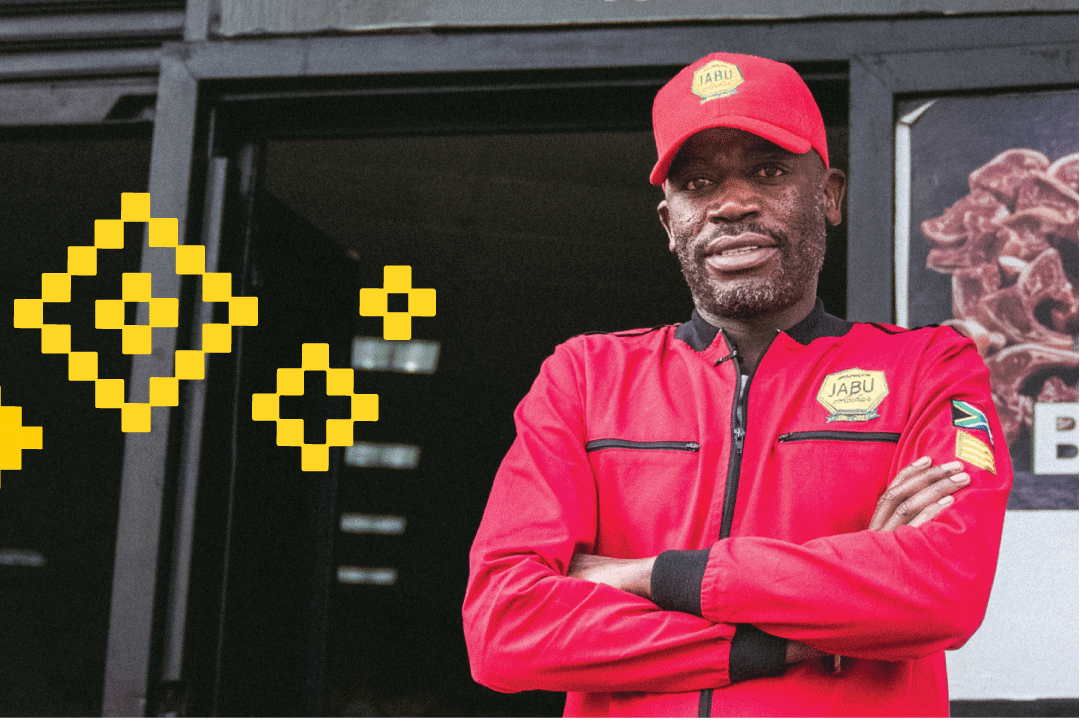

You’re not paying your staff on time

If you have a good one, your team is the backbone of your business. Consistently delayed payments can lead to low morale, high staff turnover and even legal complications.

Late payments to suppliers and vendors

Falling behind on payments to suppliers can harm your relationships with them. Without a reliable supply chain, your business risks grinding to a halt.

Cash flow issues can start with late customer payments

Late customer payments can create a domino effect, leaving you short on funds to cover your expenses. There is a difference between being kind and shooting yourself in the foot. At the end of the day, it’s not your responsibility to carry the cost when a customer doesn’t pay, especially if it puts your business under financial pressure.

Reduced credit limits or cancelled credit lines

If your business’s credit is reduced or your credit line is cancelled, it means that you have less or no access to funds that help you cover unexpected costs. Credit should be your financial safety net if things go wrong because of unforeseen circumstances, not something you rely on regularly to stay afloat.

Growth stalls when you have cash flow problems

Struggling to generate enough cash flow means you’re likely missing opportunities to expand, upgrade, or improve your business. Without investment, staying competitive and meeting future demand becomes an uphill battle.

Decreased cash reserves point directly to cash flow issues

A dwindling cash reserve signals that your business lacks a cushion for emergencies. Healthy cash flow ensures you have funds set aside to weather any storm.

Each slow period is worse than the last

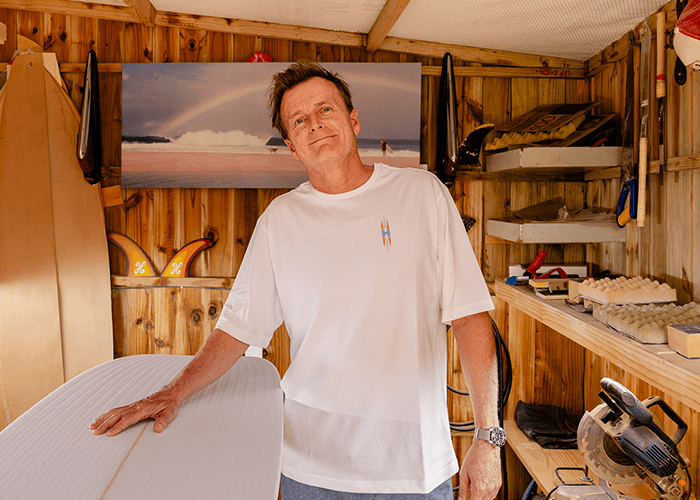

Every business has its quiet seasons; it’s part of the game. The key is knowing how to ride the wave without letting it sink your cash flow. There are many factors for this: the economy, the weather, trends, Januworry, you name it. A pattern of slow periods year-round means it is essential for you to have healthy cash flow to keep your business afloat during those periods.

You’re dipping into personal funds

You will never truly understand and conquer cash flow if you are constantly transferring personal funds to fund your business bank account. It gives you an inflated sense of security and leaves you stressed, never truly knowing how much money is going in and out of your business. Think of it like this: every time you put money from your personal funds into your business, you are investing in your business. But would you be an investor in a business that can’t pay its staff or bills on time?

Your debt is catching up with your income

Is the money you owe, like loans or credit cards, getting closer to or even exceeding the amount of money your business is bringing in? If most of your income is going towards paying off your debt instead of covering everyday expenses, this means your cash flow habits are unsustainable.

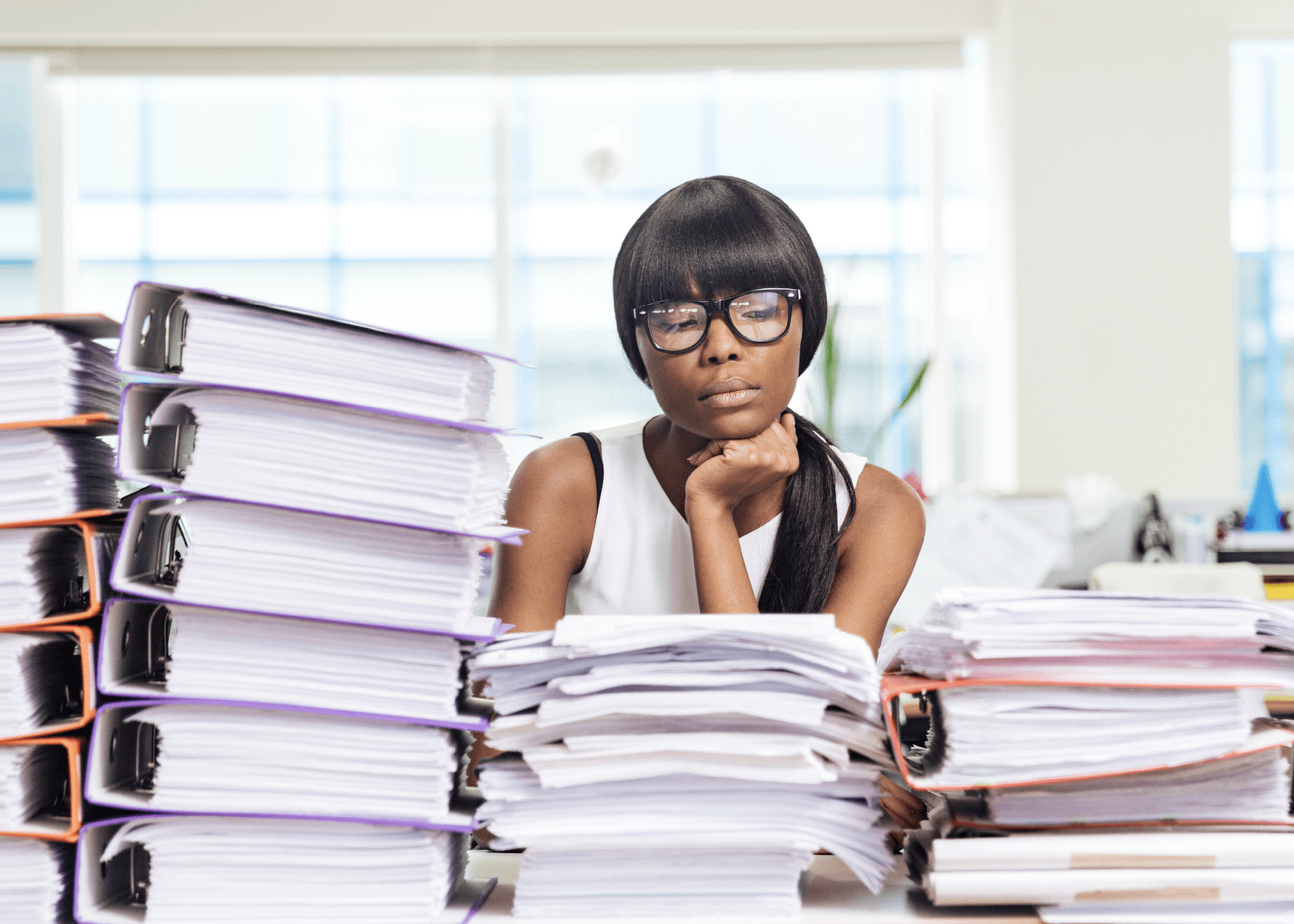

You’re ignoring the numbers

Many South African business owners feel overwhelmed by numbers but ignoring them won’t make the problem go away. Understanding cash flow doesn’t have to be daunting. Start small, give yourself grace, and remember that every step forward, even if small, is progress.

If any of these warning signs feel familiar, know that you’re not alone, and it’s not too late to turn things around. Every business faces challenges, and addressing cash flow problems is part of the journey toward long-term success.