The True Impact of Poor Cash Flow on Your Business

How poor cash flow affects your business: risks, consequences and realistic solutions.

BY Sarah Heron

You’ve seen the signs. You’ve learnt what cash flow is and how to calculate it. But what happens after that?

This is where the rubber meets the road.

Because poor cash flow doesn’t just sit quietly in your books. It affects everything -your stock levels, your staff, your growth plans, even your sanity. Often, it creeps in silently. You miss one payment, delay one decision, borrow from one account to cover another. Then, slowly, things begin to unravel.

In this article, we’re unpacking the real impact of cash flow on a business - the tangible and intangible consequences that can cost you more than just money.

Not sure if cash flow is a concern yet? Start here: 10 warning signs you have cash flow issues in your business

You run out of stock. Customers walk away.

Stock is one of the first things to suffer when cash flow’s tight. Without available funds, you can’t replenish fast-moving items or prepare for peak demand. The result? Empty shelves. Missed sales. And disappointed customers who’ll find what they need elsewhere.

Worse still, you risk damaging your brand reputation. A customer may forgive you once. But if stock-outs become a habit, you could lose them for good.

Your projects start falling behind

For businesses that rely on project-based work, like construction, design or consulting, poor cash flow causes a chain reaction.

You can’t pay your suppliers on time. Your team has to wait for wages or materials. Everything slows down. Eventually, delays snowball into missed deadlines - and missed deadlines can damage client trust beyond repair.

Never miss a payment with these 15 fool-proof ways to get paid on time

Your marketing dries up - and so does your pipeline

Marketing isn’t just a “nice to have” - it’s how you generate leads, attract new customers, and stay top-of-mind. But it’s often the first thing to get cut when cash gets tight.

Without consistent marketing, your sales pipeline begins to shrink. Fewer enquiries. Fewer new customers. Fewer opportunities to grow.

This makes cash flow even worse. And suddenly, you’re in a cycle that’s hard to escape: you can’t afford to market, and you can’t grow without marketing.

Your team feels the pressure

Running a business is personal - and when cash flow becomes a problem, that pressure is hard to hide.

Maybe salaries are late. Maybe you can’t commit to bonuses or training. Maybe you’re short-staffed and can’t afford to bring someone new in. All of this takes a toll on your team. And when people feel uncertain, morale takes a hit.

Worse still, your best staff - the ones holding things together - may decide to leave for more stable opportunities elsewhere.

Your supplier relationships start to suffer

Most South African entrepreneurs know the importance of solid supplier relationships. These partnerships are built on trust, and trust requires consistency.

When you pay late, ask for repeated extensions, or dodge communication altogether, that trust begins to erode. Over time, suppliers may reduce your credit terms, push you to pre-pay, or stop doing business with you altogether.

The longer the strain goes on, the harder it is to rebuild those relationships. In some industries, a bad reputation can follow you.

Your business becomes less valuable

The impact of cash flow on a business extends beyond day-to-day survival. It directly impacts how your business is valued by lenders, partners, and investors.

Healthy cash flow shows that your business is stable, sustainable, and investable. Poor cash flow? That raises red flags - no matter how good your product or service is.

If you’re hoping to secure funding, attract investors, or eventually sell your business, your cash flow will be under the microscope.

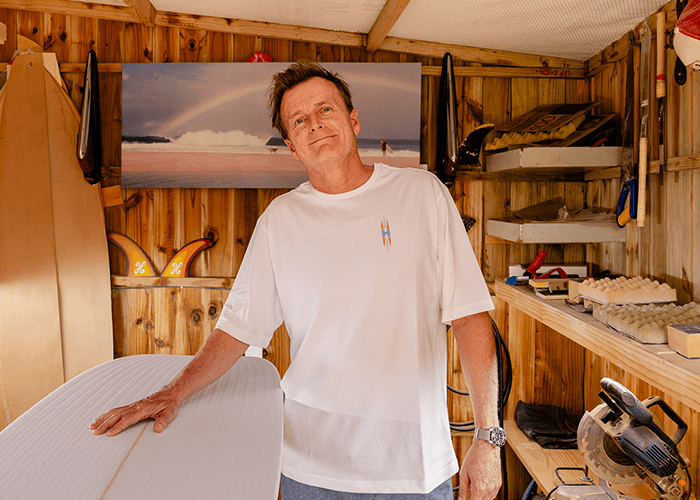

You burn out

This might be the hardest hit of all, and the one no one talks about enough.

Running a business with poor cash flow is exhausting. It means constantly putting out fires, worrying about bills, and never feeling like you’re moving forward. The mental and emotional toll is real, and over time, it can affect your health, your relationships, and your motivation.

If you’re feeling this right now, you’re not alone. And it doesn’t mean you’ve failed - it just means you need a plan.

If you’re on the brink (or in the thick) of business burnout, here’s another read for you: 7 Ways to Manage Small Businesses Burnout

So, what can you do?

Like Sibusiso from Black Crystal Ink Studio says:

“Understanding cash flow has helped me positively iron out the liabilities in my business and have more attention on costs, profits, sales, savings, and investments.”

Clarity is everything. Once you see your numbers clearly, you can take action- whether that’s renegotiating supplier terms, following up on outstanding invoices, or adjusting your pricing and expenses.

If invoicing is the issue, go digital...and free. Find out about how to get paid like a pro with iK Invoice