POS for home and professional services

every service

and payment effortless

your day-to-day

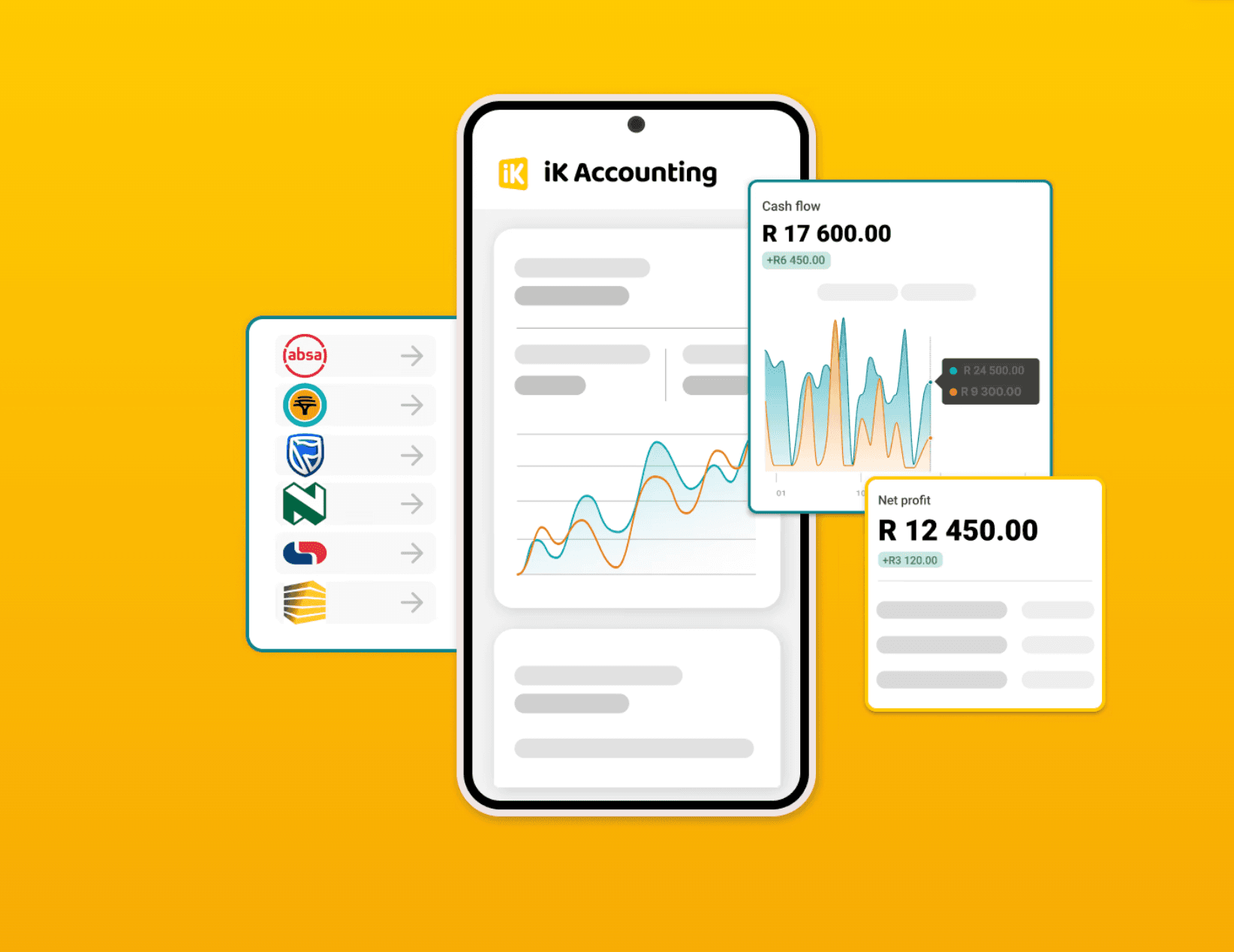

Save up to 5h per week when you use online accounting software.*

*Estimation based on trends observed in the current market for online accounting software for small businesses.

Success stories from

service pros

See how home and professional service businesses across South Africa are using iKhokha to simplify payments and grow their business.

Power Up Your Profits: How to Grow a Small Electrical Business in South Africa

Grow your electrical business in South Africa with tips on branding, referrals, payments, contracts, and cash flow.

How to Start a Gardening Business in South Africa

Learn how to start a garden service business in South Africa with clear costs, simple steps, pricing guidance and practical advice for landing your first clients.

How to Start a Laundry Business in South Africa

Discover how to start a laundry business in South Africa. From home setups to laundromats, learn costs, equipment, and tips to grow with ease.

How to Start a Car Wash Business in South Africa

Learn how to start a car wash business in South Africa, from setup and costs to marketing and payments. Turn soap and buckets into a thriving hustle.

FAQ's

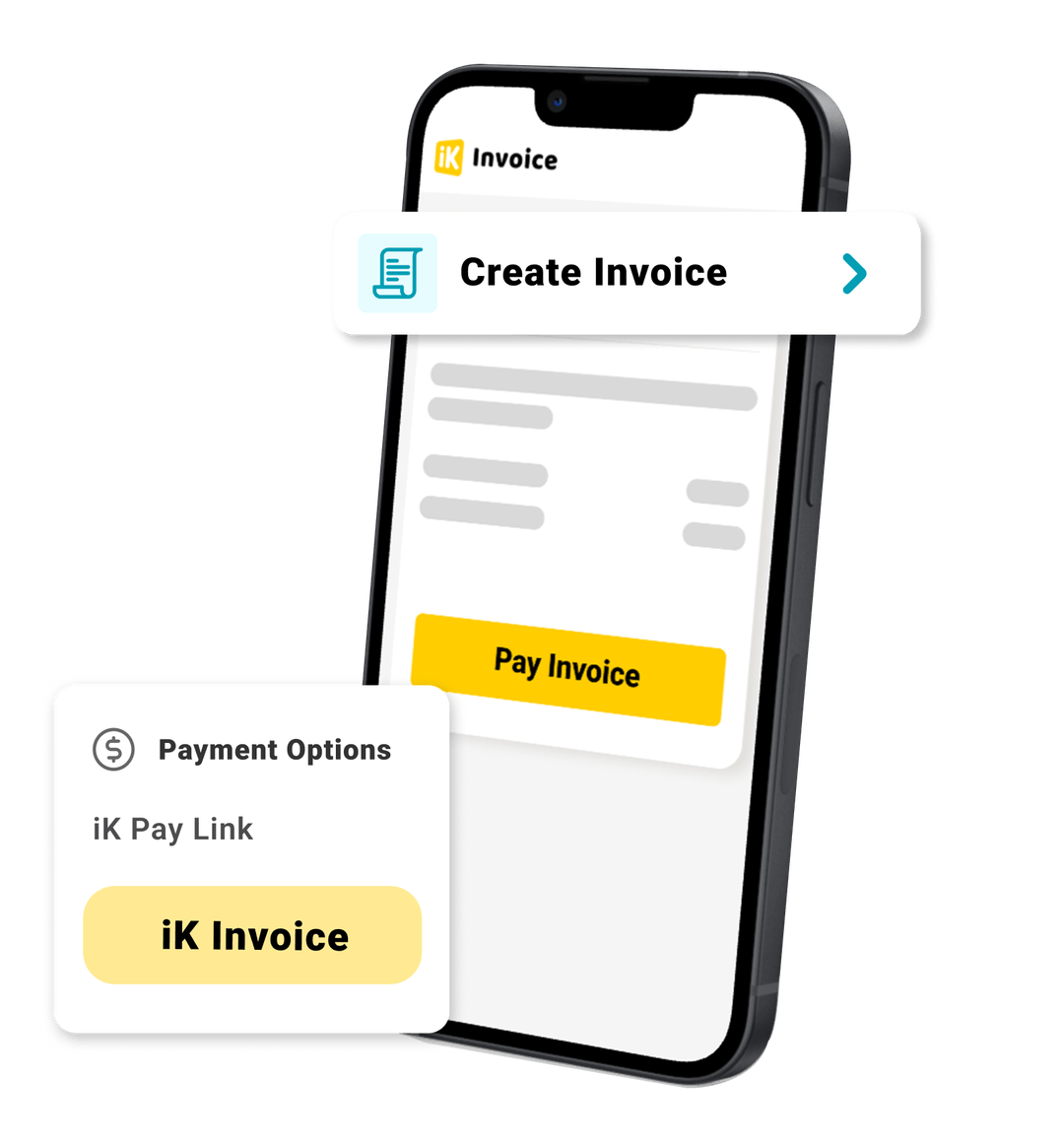

Yes! iKhokha has plenty of payment options that let you accept card and digital payments anywhere, whether you’re at a client’s home, on a job site, or in your office.

Payments are processed quickly and securely. Depending on your account settings, funds can appear the same day or within 1–3 business days. If you have an iK Debit Card*, you can get same-day payouts, 365 days a year!

*Only available to sole props

Yes! With iK Pay Link, you can send a secure payment link directly to clients, making it easy to get paid before, during, or after a service. This tool is also great for accepting deposits.

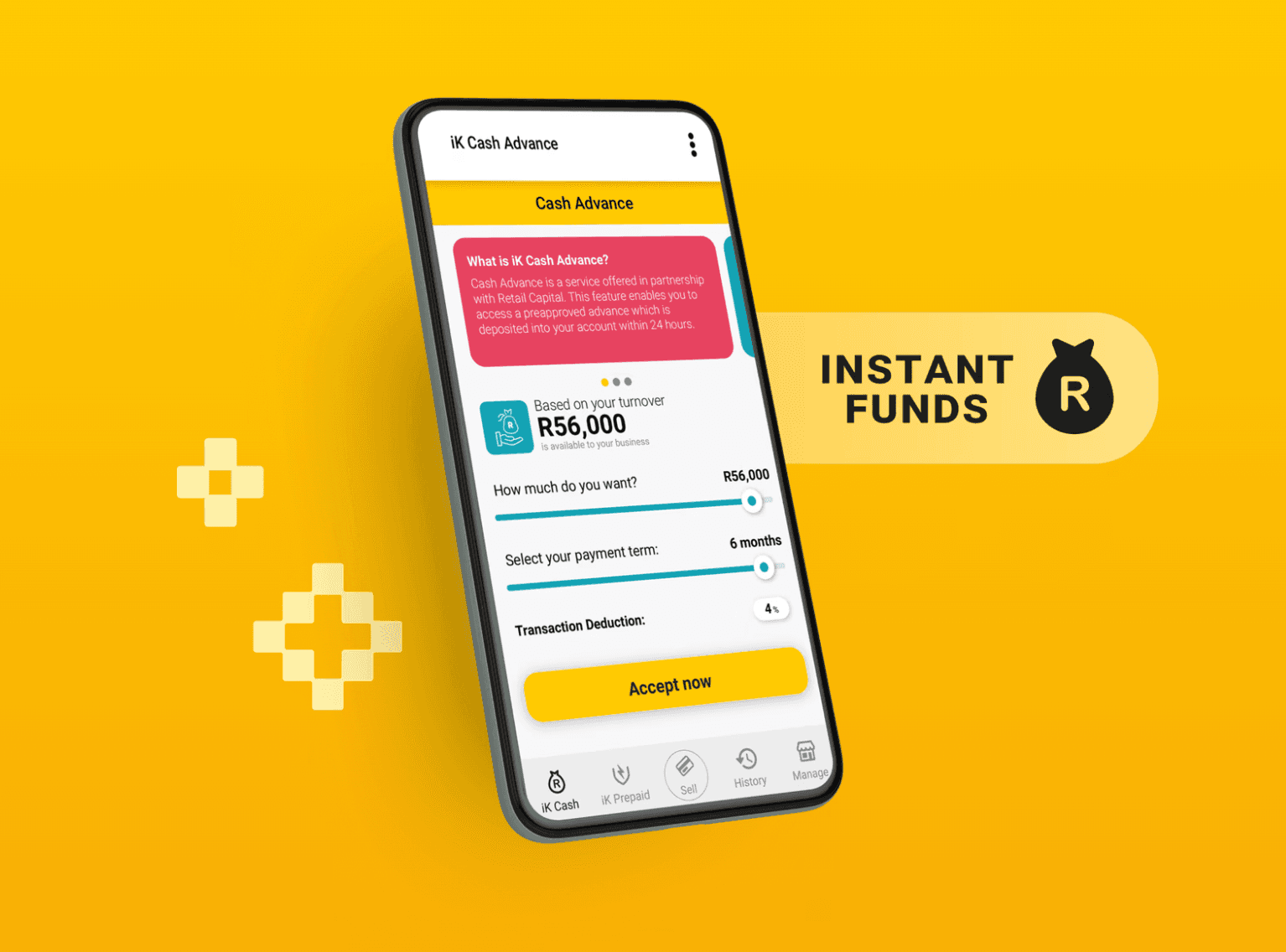

Yes! iK Cash Advance provides fast access to business funding to buy supplies, hire extra help, or cover unexpected expenses.