What’s an iK Cash Advance?

An iK Cash Advance is a fast and flexible small business funding solution designed to help South African entrepreneurs grow. Get instant access to working capital based on your card sales – no paperwork, no waiting, just the business finance you need, when you need it.

- Be an active iKhokha merchant for at least 6 consecutive months.

- Make more than R2 500 in sales per month.

167%

Merchants saw 167% in sales over 3 months after taking a iK Cash Advance.

Feel inspired

“iKhokha helped me with instant cash injections in the form of iK Cash Advance. Sometimes, you lose hope in business when you don’t have enough capital, and iKhokha supported me so much during that time.”

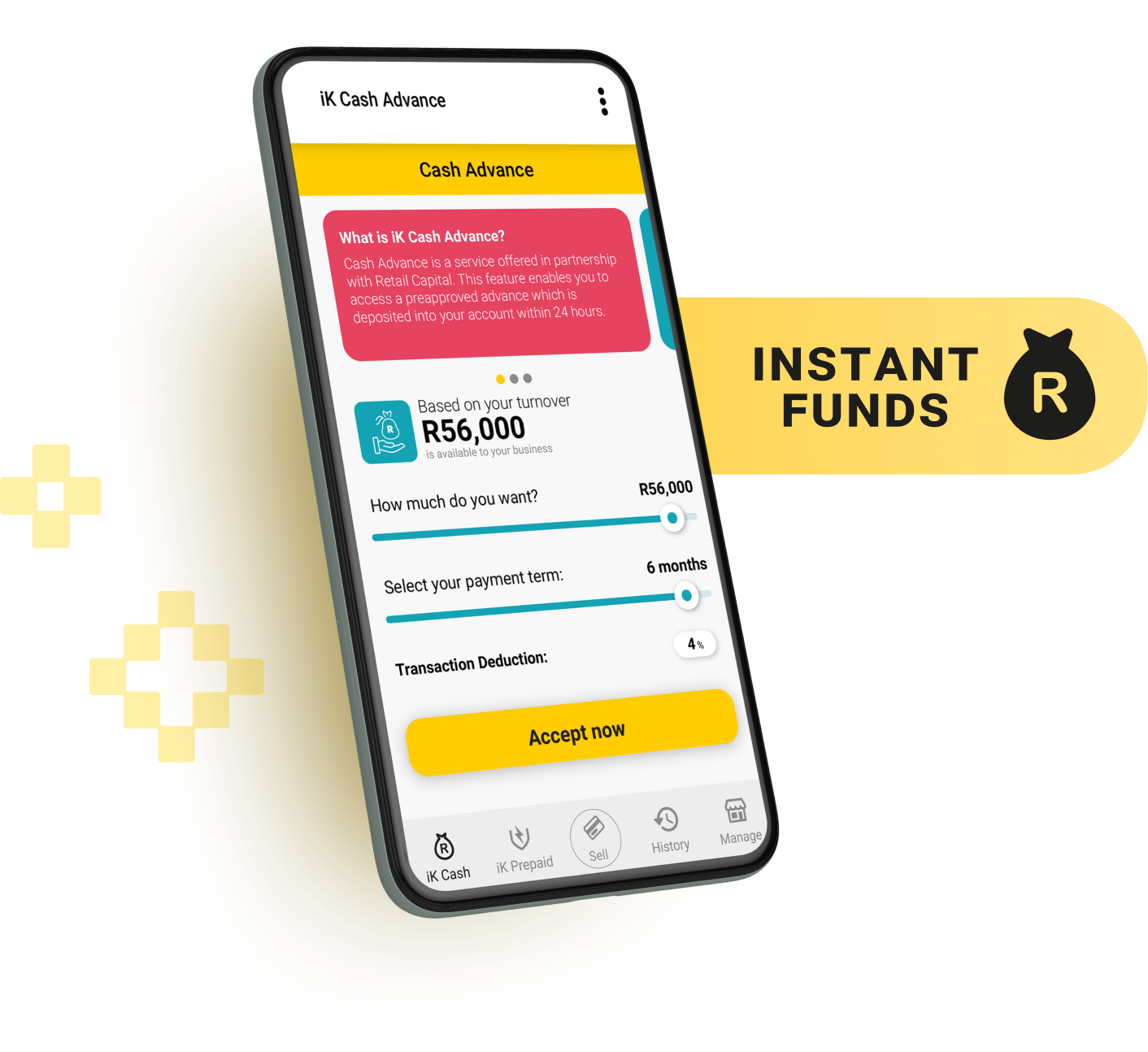

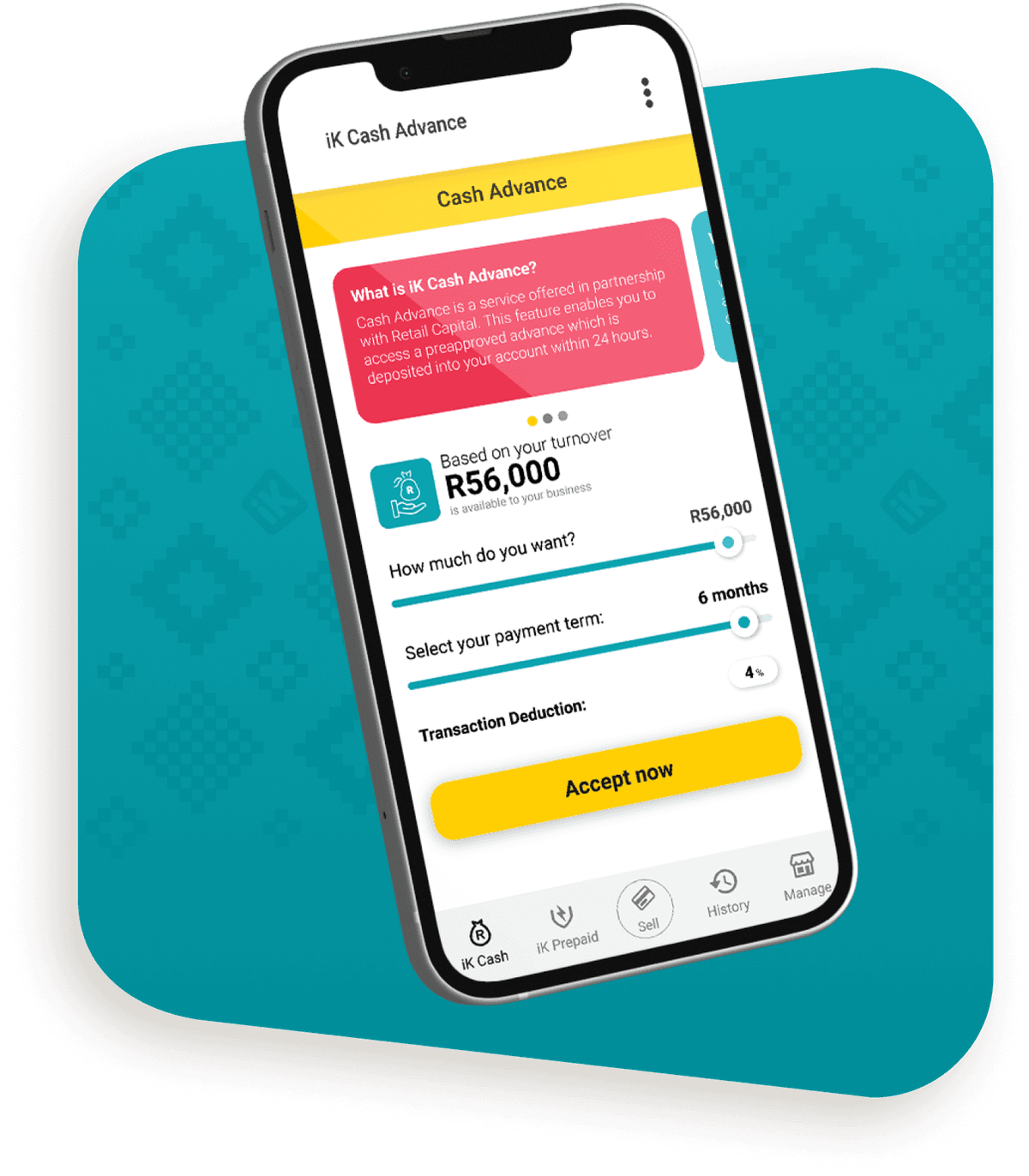

Where to find your iK Cash Advance offers

You can only view Cash Advance offers on the iKhokha App.

Product Features

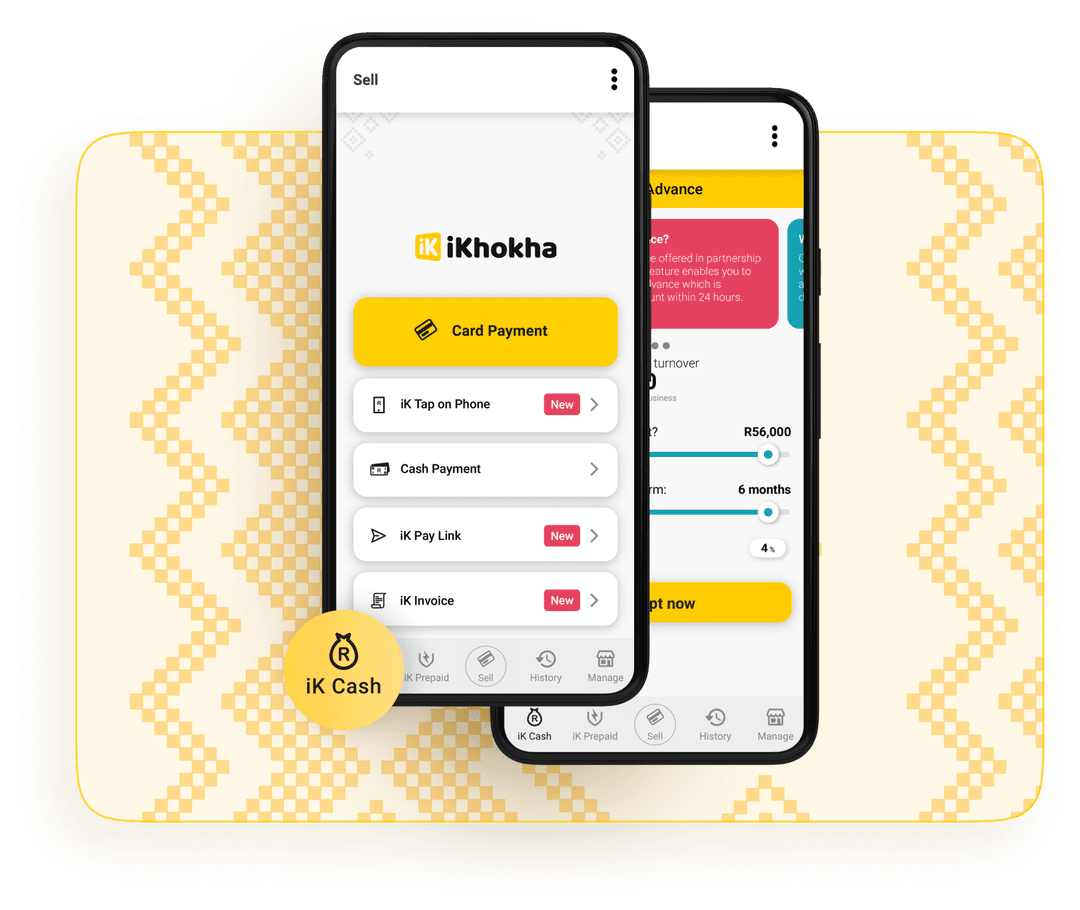

- 1Sign up to create your free iKhokha profile.

- 2Download the iKhokha App from your app store and login using your profile's details.

- 3Tap “iK Cash” to see if you qualify and how much you could get.

- 4Accept an offer you’re happy with to get funding in 24 hours.

- 5Keep a healthy repayment history to qualify for more funds with an iK Cash Advance Top Up.

Easy repayments

Every swipe, insert and tap helps you pay back your iK Cash Advance.

Your iK Cash Advance is paid off through a small percentage being deducted from future card sales. This means that you only pay back whilst you are making sales through your iKhokha card machine.

FAQs

Your business must be trading for 6 months consecutively and have a minimum monthly turnover of R2 500 in order to qualify. Ts and Cs apply.

We don’t tell you how to use your funding. No one knows your business better than you – you are free to decide how you want to use it.

Disbursement takes place on the first business day after signing. Your funds should be in your bank account within 24 hours of disbursement (subject to your bank’s turnaround times).

Payment is made via split processing: a specified percentage of your daily turnover will be used to pay back your advance.

Need help?

Get help instantly on WhatsApp, our chatbot Kelly, or by requesting a callback.

You can also call 087 222 7000 or email support@ikhokha.com