Is iKhokha Legit? 10 Facts You Need to Know About iKhokha

Asking yourself, Is iKhokha Legit? We'd love to share a little bit more about South Africa’s most exciting fintech. Come along for the journey.

Table of Contents

- Introduction

- 1. We’ve been around for over 13 years

- 2. We build our products ourselves

- 3. Our card machines let you sell anywhere

- 4. We’ll get you selling online too

- 5. The iKhokha App is your business command centre

- 6. Sell more with iK Prepaid

- 7. Quick, flexible business funding

- 8. POS solutions that keep you moving

- 9. Low Rates, No Rental Fees

- 10. Merchants come first here

- Bonus: learn, grow, repeat

Maybe you’ve spotted us on a billboard while stuck in traffic, caught a glimpse of our bright yellow in a social media ad, or seen one of our TV commercials while enjoying your favourite show. And now you’re wondering: What’s the story with iKhokha? Can they really help my business grow?

Short answer? Absolutely.

At iKhokha, we’ve got one mission: to help South African small businesses thrive in the digital economy. Whether you’re just starting out or already on the move, we’ve got the tools to help you sell, get paid, and keep growing.

From Tap on Phone to our powerful card machines, a free business app, online payment tools, prepaid products, funding, and even same-day payouts with the iK Debit Card, we’ve built an ecosystem that keeps you in control. And because we’re proudly South African, every tool we make is designed with our way of doing business in mind.

Here are 10 things you should know about us (plus a bonus tip at the end).

1. We’ve been around for over 13 years

In a world where startups pop up and disappear overnight, lasting more than a decade says a lot. We started iKhokha back in 2012 - “iKhokha” means “to pay” in isiZulu, with a simple idea: give small businesses an easy, affordable way to accept card payments.

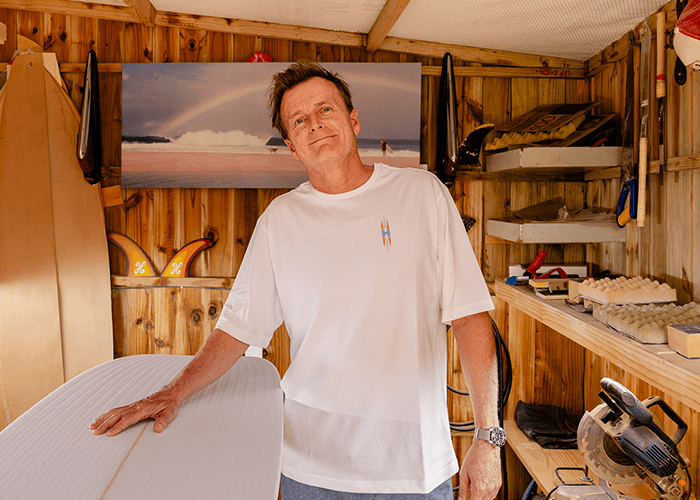

Founders Matt Putman and Ramsay Daly kicked things off in a garage (as many good South African stories do), working to break down the barriers that kept small businesses locked out of the digital economy. Back then, card machines came with sky-high rental fees and complicated contracts. We thought that was nonsense, so we built something better.

Fast forward to now, and we’re one of South Africa’s leading fintech companies. We’ve kept our garage-startup energy, but grown into a team of over 300 people, all working towards one thing: making it easier for you to do business.

2. We build our products ourselves

When we say “we made this for you,” we mean it. No outsourcing to random overseas teams, everything is designed, developed, and tested by our crew right here in Umhlanga.

Our product owners, designers, developers, and engineers sit together, come up with ideas, prototype them, test them with real merchants, tweak what needs tweaking, and roll them out. That’s how we make sure our products aren’t just fancy tech, they actually solve South African business problems.

It’s also how we can adapt fast. Need something improved? We can do it ourselves. Plus, keeping development local means we’re creating jobs and growing skills right here at home.

3. Our card machines let you sell anywhere

Every business is different, so we’ve got three ways for you to take payments in person:

Tap on Phone

If you’ve got a compatible Android phone, you’ve already got a card machine in your pocket. Just download the iKhokha App, sign up, and you can start accepting tap-to-pay cards and digital wallets instantly, no extra hardware needed.

iK Flyer

Our top-of-the-line fast card machine. Big, bright touchscreen, built-in printer, dual SIMs, Wi-Fi backup, and wireless charging. It’s designed for speed and reliability, so you never miss a sale because of tech glitches.

iK Flyer Lite

Think of it as the Flyer’s smaller, more portable sibling. It’s pocket-friendly, has all-day battery life, and still comes loaded with features like catalogue management, smart tipping, and digital receipts.

Whichever you choose, pair it with the iK Debit Card and you can get your money on the same day you make the sale, no more waiting days for a payout.

4. We’ll get you selling online too

More customers are shopping online than ever before, but setting up an online store can feel overwhelming. We make it simple.

Our ecommerce tools include:

- iK Pay Link – Send your customer a payment link via WhatsApp, SMS, or email.

- iK Invoice – Create and send branded invoices in minutes.

- iK Webstore – Build an online shop quickly, no coding needed.

- Plugins for Wix, WooCommerce, and Shopstar – Integrate payments into your existing website.

All payments go straight into your account (or onto your iK Debit Card for same-day payouts). You manage everything through your iKhokha App or Dashboard, so you can keep your finger on the pulse, even if you’re running things from your couch.

5. The iKhokha App is your business command centre

Our free app turns your smartphone into a full-on business toolkit. No subscriptions. No hidden fees. Just download it from the App Store, Google Play, or Samsung Galaxy Store and you’re ready to roll.

From the app, you can:

- Take card payments (via Tap on Phone).

- View and track your sales in real time.

- Sell prepaid products and earn commission.

- Apply for funding.

- Send invoices and payment links.

- Access detailed business reports.

It’s designed to work perfectly with the iK Flyer and iK Flyer Lite too, so whether you’re selling with a phone or a card machine, you’ve got the same powerful tools at your fingertips.

6. Sell more with iK Prepaid

Your customers already buy airtime, data, electricity, and DStv somewhere - why not from you? With iK Prepaid, you can sell these essentials (and more) directly from your iKhokha App and earn commission on every sale.

It’s an easy way to boost your profits without needing extra stock or space. All you need is Tap on Phone or an iK Flyer. Just log in, select the product, and you’re done. Your customer gets what they need, and you get a little extra cash in the till.

7. Quick, flexible business funding

Unexpected expenses happen. Opportunities come up out of nowhere. That’s why we offer iK Cash Advance, a fast, fuss-free way for eligible merchants to get funding.

Instead of paying a fixed monthly amount, you pay back a small percentage of your daily card sales. That means if business is slower one day, your repayment is lower too. It’s flexible, fair, and designed to work with your cash flow, not against it.

8. POS solutions that keep you moving

A good point-of-sale system isn’t just about ringing up sales, it’s about keeping your business running smoothly. Our POS solutions make it easy to:

- Accept payments quickly.

- Track stock in real time.

- Manage suppliers.

- Pull up business reports from anywhere.

Pair our POS software with the iK Flyer or Flyer Lite, and you’ve got a checkout experience that keeps queues moving, customers happy, and your business in control.

9. Low Rates, No Rental Fees

We believe in keeping more of your hard-earned money where it belongs, with you. That’s why our transaction rates start from 2.75% excl. VAT, and we offer custom rates for bigger businesses.

You’ll never pay a monthly rental fee for your device, it’s yours once you buy it. And if you’ve got an iK Debit Card, you can skip the wait and get your funds the same day. Prefer a standard bank payout? That takes 1–3 business days, with just a R2.50 settlement fee on days you trade.

10. Merchants come first here

We’re not just here to sell you a card machine and disappear. We’re here to help you grow. That means giving you marketing support, sharing your success stories, and offering customer service that actually picks up the phone.

When our merchants win, South Africa wins and that’s what keeps us going.

Bonus: learn, grow, repeat

Our blog and free monthly newsletter are packed with tips, product updates, and real stories from South African entrepreneurs. Think of it as your monthly dose of motivation and know-how, delivered straight to your inbox.