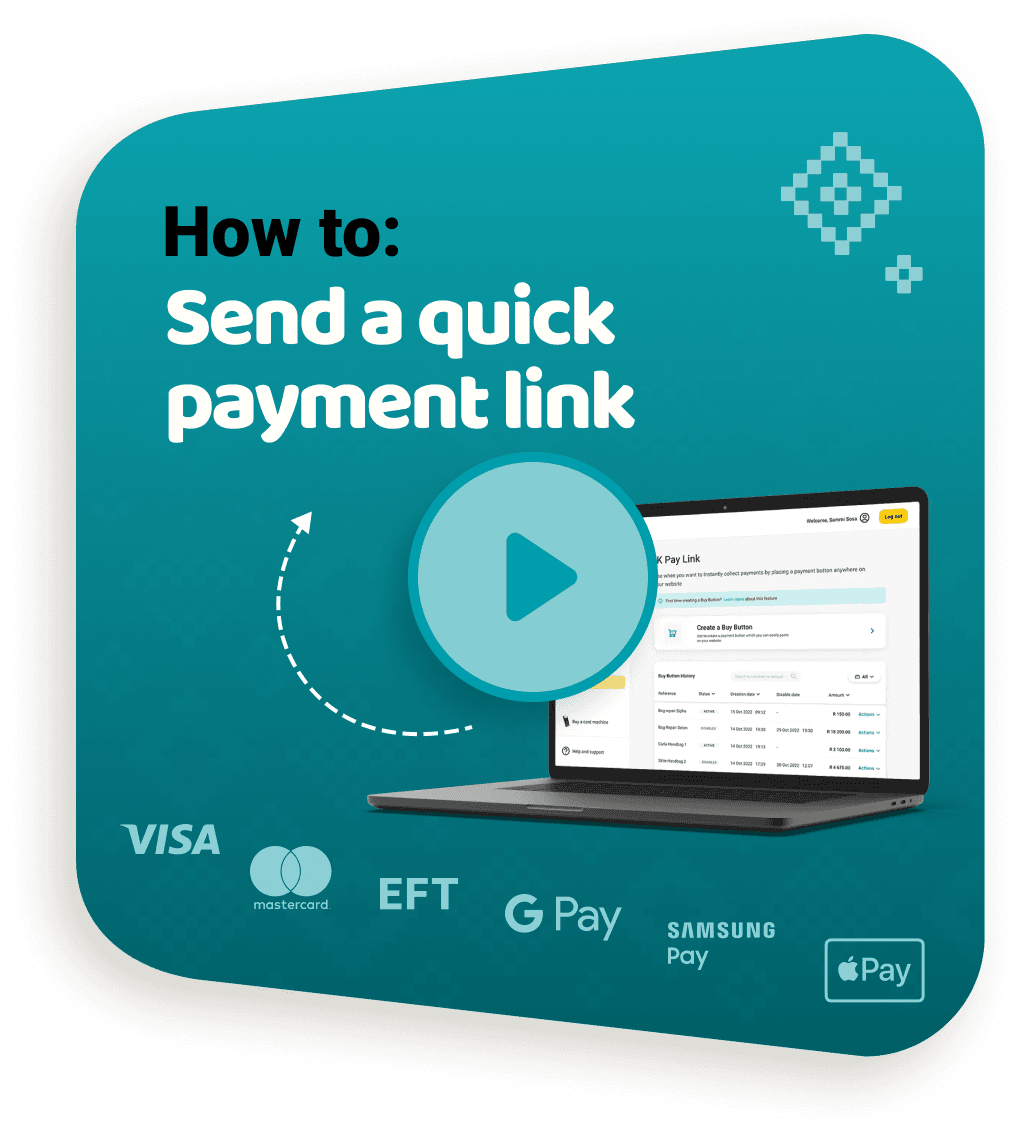

iK Pay Link: Create a payment link. Send it. Get paid!

Send payment links directly to your customers and get paid with iK Pay Link.

iK Pay Link accepts:

What is a Payment Link?

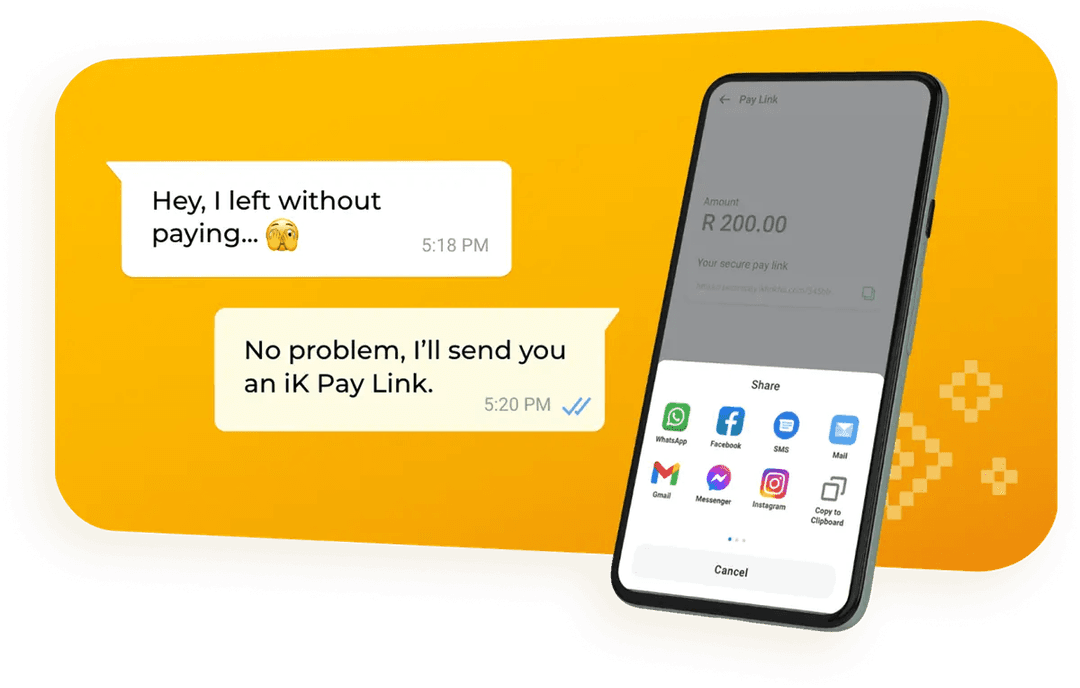

A payment link is the easiest way to get paid online, no website, no fuss. Just create a link, send it via WhatsApp, SMS or email and your customer pays using their card or bank. It’s fast, secure, and you get the cash straight into your account.

No tech skills needed. No waiting. Just link it. Send it. Get paid.

Trusted by the experts: Mzansi’s business owners

Why trust iKhokha? We’re highly rated on Google, Trust Index, and Hellopeter. We’re also the winner of MTN’s 2023 App of the Year award.

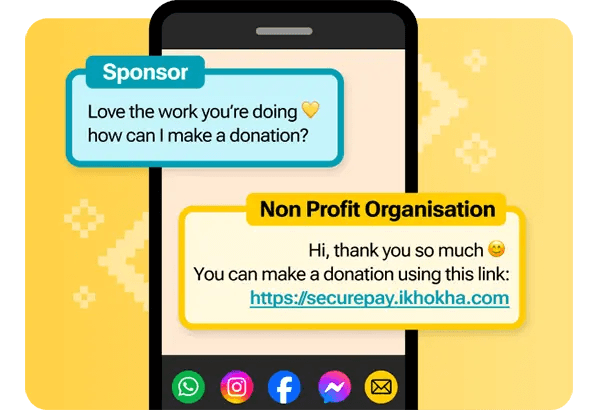

Use social media to sell

Get paid on social media by sending your iK Pay Link or pasting it in your bio.

84%

The score our merchants gave iK Pay Link when asked how easy it is to use.

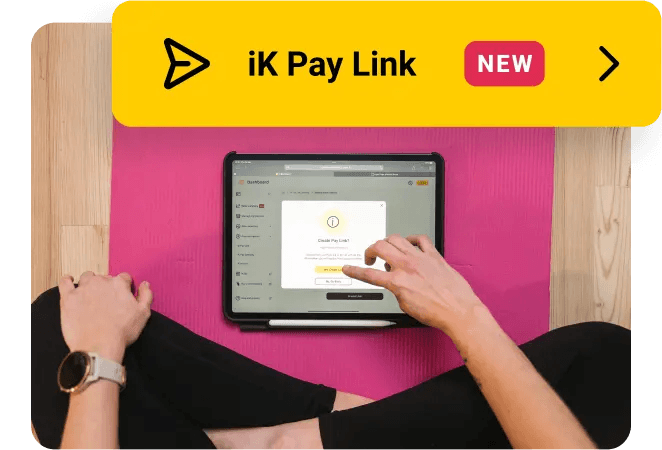

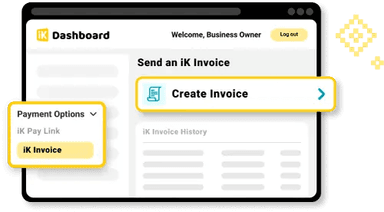

Get started with iK Pay Link

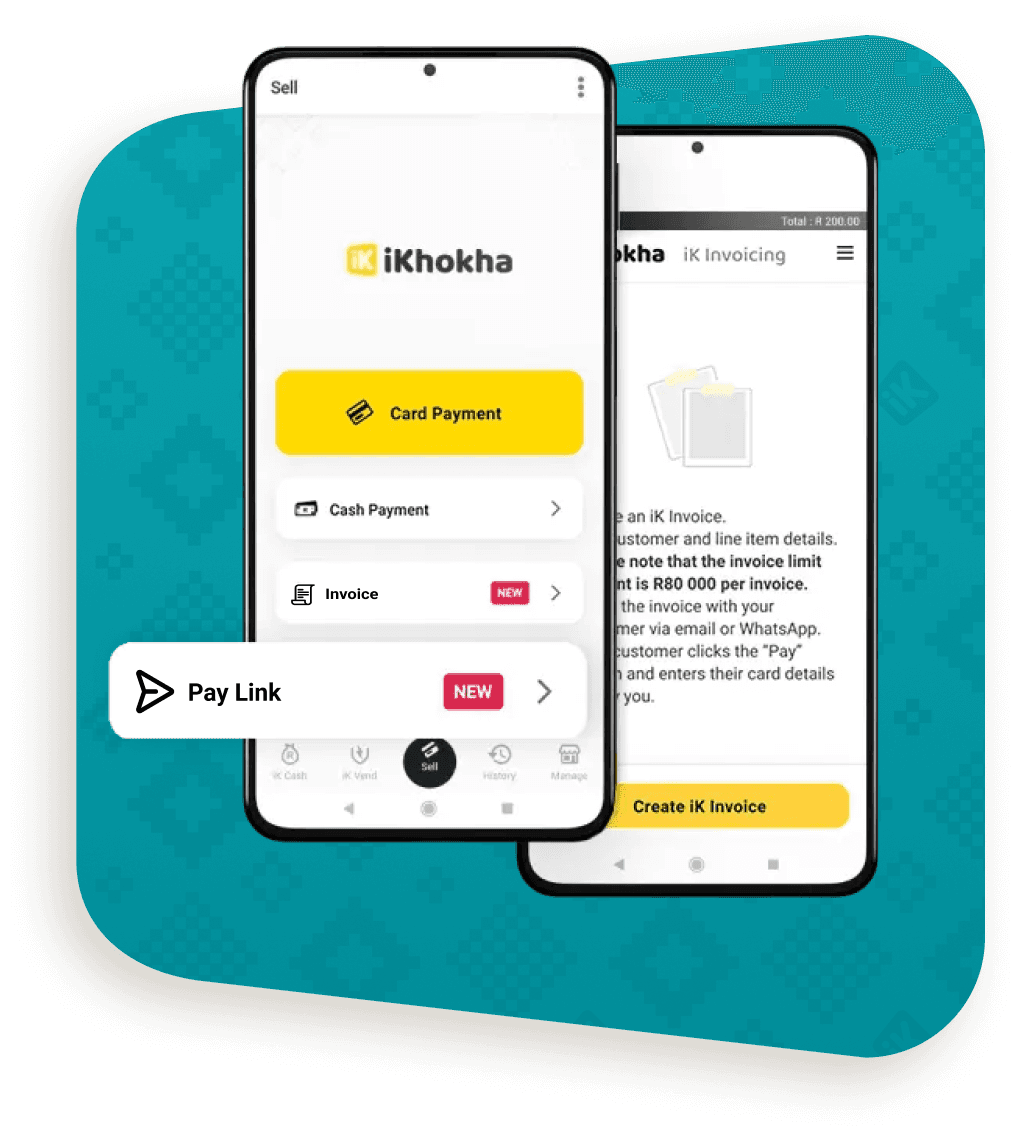

Create and send payment links anytime, anywhere, straight from the iKhokha App or iK Dashboard.

No need for a card machine or fancy setup. Just tap, type, and send. Getting paid has never been this quick and easy.

Product Features

- 1Sign up to create your free iKhokha profile.

- 2Login to your iK Dashboard or download and login your iKhokha App.

- 3Open the iK Pay Link and create your payment link.

- 4Copy and paste it in your chat, send it, and get paid!

Better ways to get paid with iK Pay Link

Tools for a better business

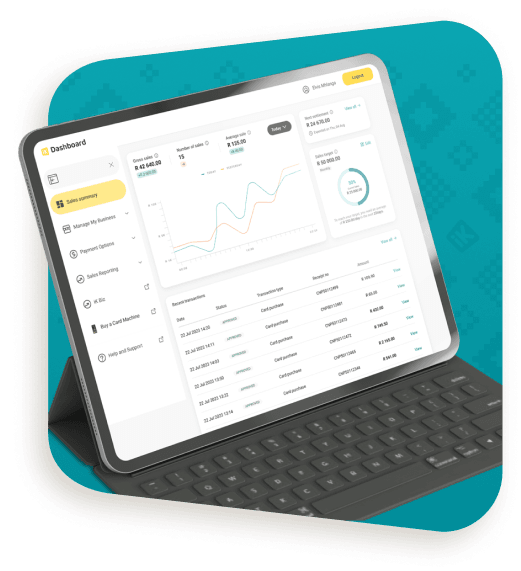

Run your business

Keep track of your sales history and monitor transactions with iK Dashboard.

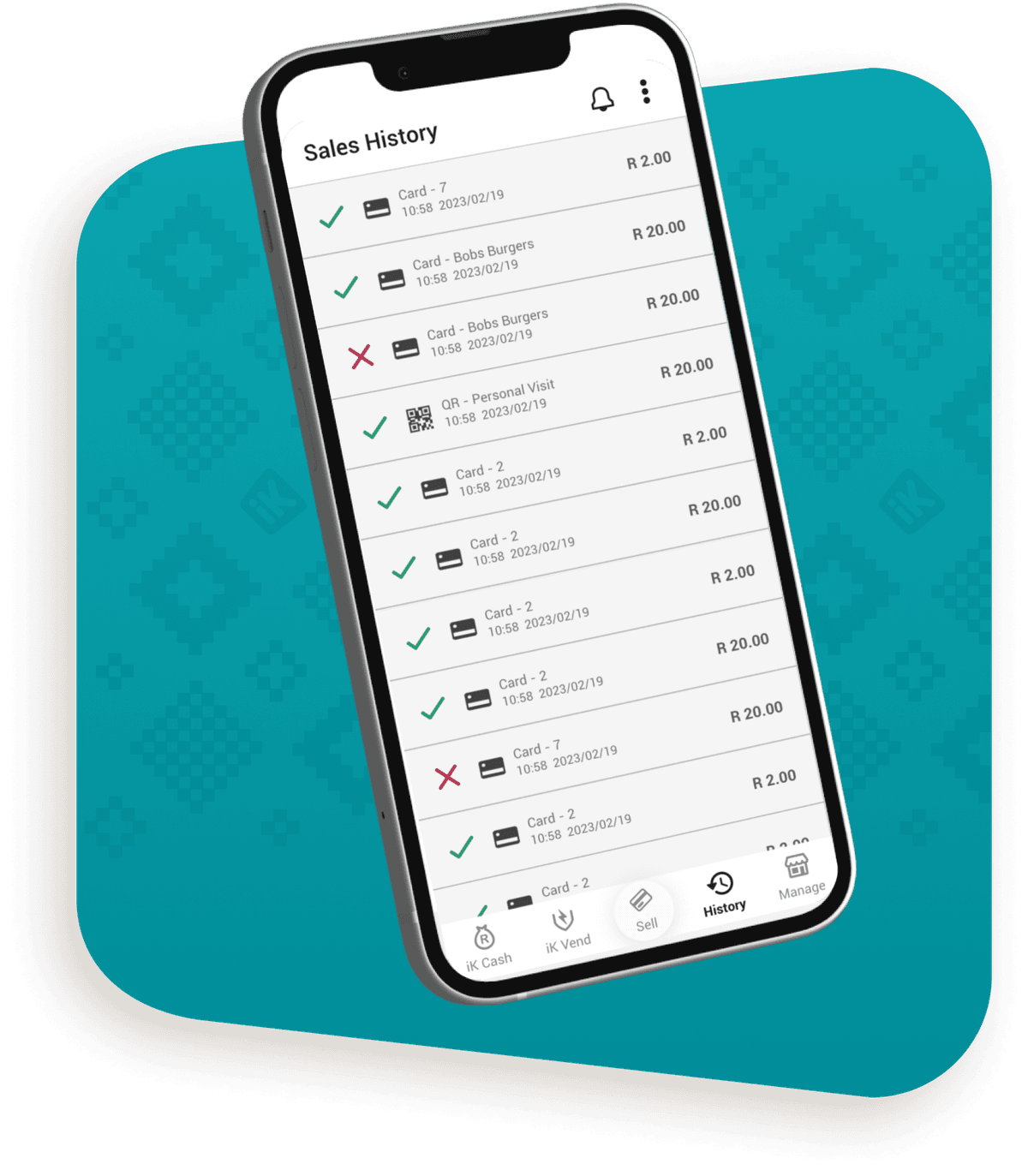

Keep an eye on stock and staff

Run your business from anywhere with real-time updates on your smartphone using the iKhokha App.

Sell prepaid products

Attract more customers by selling airtime, data, electricity and gaming vouchers with iK Prepaid.

FAQs

No. Your customers just click the link and pay using their card or bank, no app needed.

With iK Pay Link you'll be charged the standard rate for online payments which is 2.85% (excl. VAT) per transaction.

Absolutely. Every payment is 100% secure and encrypted, with bank-level protection built in.

You can see all your payments in real time on the iK App or iK Dashboard – easy and hassle-free.

Yes! Payment links work without any hardware. All you need is a phone and the iKhokha App.

Need help?

Get help instantly on WhatsApp, our chatbot Kelly, or by requesting a callback.

You can also call 087 222 7000 or email support@ikhokha.com